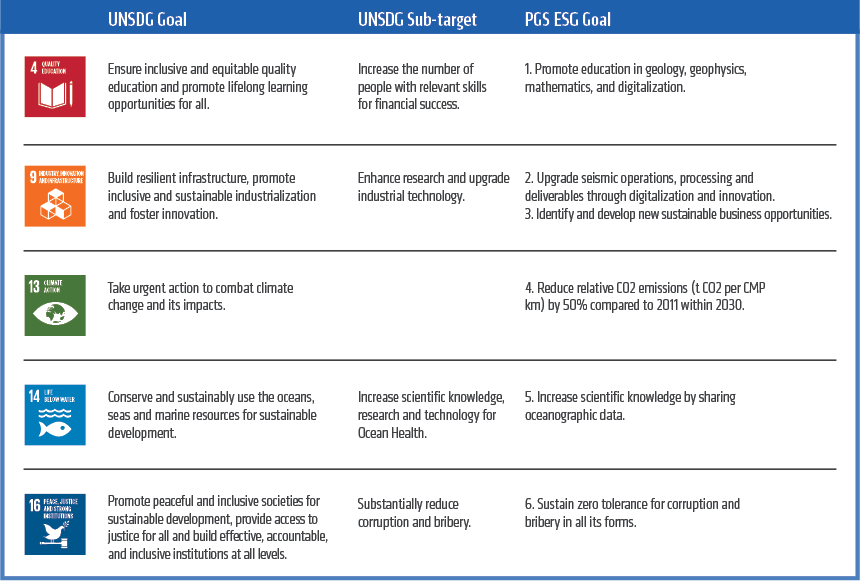

This report represents our Communication on Progress to the United Nations (UN) and demonstrates how PGS integrates ESG practices into its business and strategy. Our ambition is to promote the UN Sustainable Development Goals (SDGs) through concrete actions on goals that are relevant for our company activities and global presence. We prioritize the following SDGs:

ESG Strategy & Goals

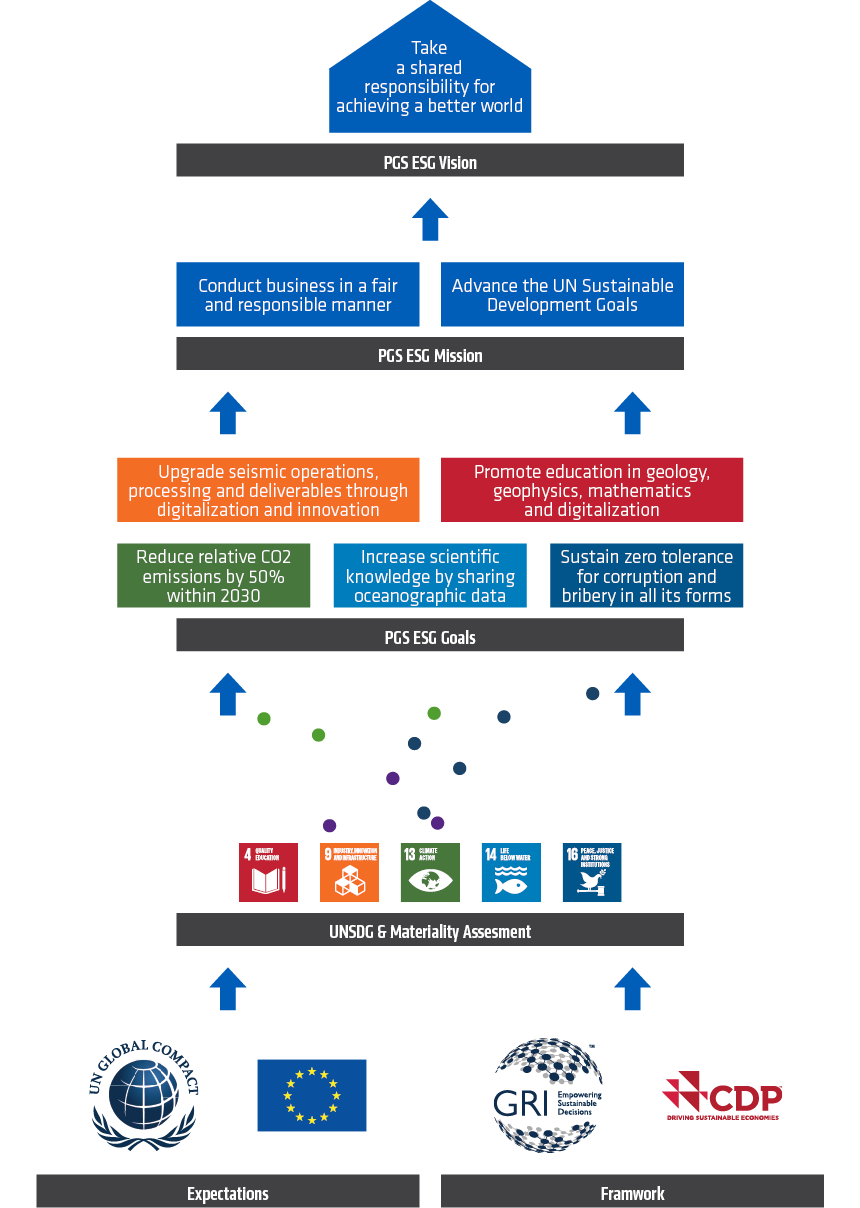

PGS has aligned its efforts on ESG to its business strategy, developing an integrated ESG strategy with company-specific goals based on the sub-targets for each of the UN SDGs we have committed to support. In 2021, we will build upon our efforts so far and develop a plan of action to achieve these goals in the coming years.

Materiality Assessment

The backbone of this report and our ESG response, is our materiality assessment. During 2020, PGS intensified its work on ESG, mobilizing a cross-functional team to better understand the risks and opportunities, the main expectations of our principal stakeholders, and the economic, social, and environmental impacts of our activities. Our senior executive team and our Board of Directors reviewed and approved that analysis. Through internal fact-finding and research, we identified our main stakeholders and their key expectations. This is an ongoing process. We continually deepen and broaden our understanding of our stakeholder universe, through dialog combined with monitoring of our economic, social, and environmental impact.

PGS ESG Indicators

PGS has adopted a set of 17 ESG indicators that were developed from the 37 GRI standards. For each of the indicators below, the associated GRI standard(s) are referenced in brackets.

| Environment |

| Environmental compliance [307] |

| Energy and emissions [302, 305] |

| Materials, water and effluents [301, 303] |

| Biodiversity [304] |

| Waste [306] |

| Social |

| Occupational health and safety [403] |

| Diversity and non-discrimination [405, 406] |

| Employment and labor relations [401, 402, 407] |

| Training and education [404] |

| Human rights [408, 409] |

| Local communities and indigenous people [410, 411, 413] |

| Governance |

| Corporate governance [102, 103] |

| Economic performance [201, 202, 203] |

| Tax [207] |

| Anti-corruption [205, 419] |

| Anti-competitive behavior [206] |

| Procurement and supplier management [204, 412, 414, 308] |

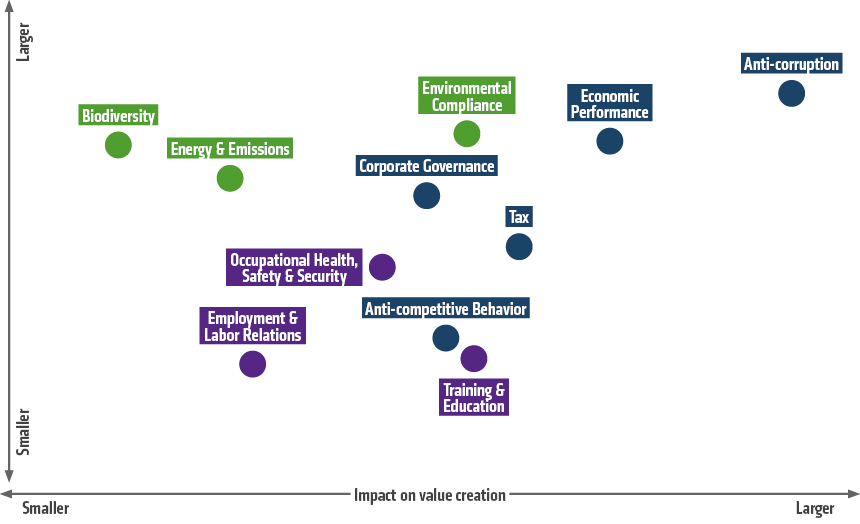

Our new materiality assessment seeks to identify the indicators of highest concern or interest to our stakeholders and those with the largest impact on value creation for PGS. Areas with limited exposure are not included on our list of material issues, as our goal is to focus our efforts where we have the highest impact and can make the most difference. Indicators reported in the present report may, therefore, differ from previous PGS responsibility reports. The reporting format has also changed, following our adoption of the GRI core option.

Materiality Assessment

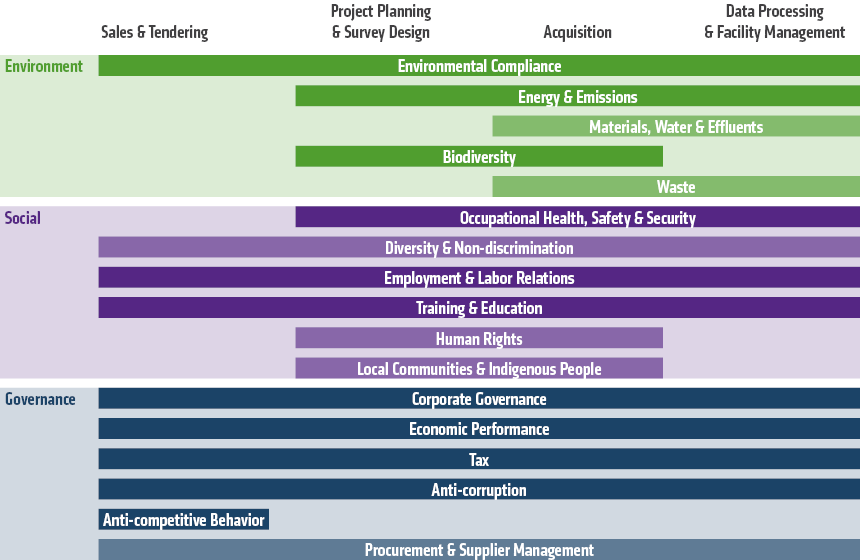

Relevance Across the Value Chain

As part of our materiality assessment, the relevance of each ESG Indicator was evaluated across our value chain. Areas with limited exposure are identified in lighter shading. Our GRI index specifies each of the GRI standards defined as material for PGS and lists the location where information can be found about the relevant disclosures included in the report.

ESG Indicators Across Value Chain

Key Stakeholders

Our future business success depends on maintaining good relations with those who depend upon us. We aim to nurture stakeholder relationships through transparent, two-way communication, to increase mutual understanding and encourage positive relationships.

Our key stakeholders include employees, clients, local communities, investors and shareholders, lenders, major suppliers and business partners, local authorities, NGOs, lobby groups, and the general public, ESG rating agencies, politicians and parliament, the media, and our competitors.

PGS Gears Up for the New Energy Landscape

The energy transition is creating new markets and causing existing ones to evolve. As part of our commitment to SDG 9 Industry, Innovation and Infrastructure, we have launched a new initiative to address the changing energy landscape. Through this initiative, we will investigate business potential outside of our core oil and gas E&P business and will be aiming to further strengthen sustainable practices throughout our value chain.

In February 2021, we stepped up and formalized our efforts by establishing a team to develop opportunities for applying our geophysical assets and expertise to the areas of carbon capture and storage, offshore wind power, and seabed minerals.

Seismic data will be a fundamental requirement in all three markets. Our goal is to fully understand how we best can apply our capabilities, as it is our ambition to build a sustainable business and service offering outside of oil and gas. Providing reliable geophysical information about the subsurface in marine environments is our core business.

Although oil and gas will be essential to energy security for many years to come, the landscape is changing. Future investments by the energy industry are increasingly directed towards new sources of energy, and reliable solutions for carbon capture and storage. PGS is well qualified to help its customers in the search for new resources and lower emissions.